child tax credit for december 2021 how much

Businesses and Self Employed Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers. For 2021 the child tax credit got upped from 2000 to 3000and up to half of it could be paid out this year before tax season.

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

Get the up-to-date data and facts from USAFacts a nonpartisan source.

. For purposes of the Child Tax Credit and advance Child Tax Credit payments your modified AGI is your adjusted gross income from the 2020 IRS Form 1040 line 11 or if. That changes to 3000 total for each child. The IRS allowed qualified individuals to receive 50 of their estimated child.

If you took advantage of the advance child tax credit payments in 2021 your family was allowed to receive 50 of your estimated credit from July through December. For 2021 only the child tax credit amount is increased from 2000 for each child age 16 or younger to 3600 per child for. How does the first phaseout reduce the 2021 Child Tax Credit to 2000 per child.

Children under 6 years old qualify for the full enhanced Child Tax Credit of 3600 if their single-filer parent earns less than 75000 or their joint-filing parents earn less than. If you have been receiving the Child Tax Credit monthly payments since July you could be given up to 1800 for each child aged five and younger or up to 1500 for each child. To be a qualifying child for the 2021 tax year your dependent generally must.

If the changes are not renewed the overall credit size will shrink by as much as 1000 per school-aged child and 1600 per child under 6 and the lowest-income families. Thats because the expanded CTC divided the benefit between monthly checks issued starting in July and ending in December with the other half to be claimed on tax returns. How much is child Tax Credit in December 2021.

For the 2021 tax year the child tax credit is upped from 2000 to 3000 per child. Be under age 18 at the end of the year Be your son daughter stepchild eligible foster child. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600.

The 2021 Child Tax Credit. Although the child is a qualifying child of each of these persons generally only one person can treat the child as a qualifying child for the Child Tax Credit. To be eligible for the.

Child tax credit enhancement Most parents have automatically received up to 300 for each child up to age 6 and 250 for each one ages 6 through 17 on a monthly basis which. The family may be eligible for a maximum child tax credit of 9600 3600 3000 3000. That goes up to 3600 for children under the age of six.

Ad File a free federal return now to claim your child tax credit. The Child Tax Credit was increased in 2021 to 3000 for children over the age of six and 3600 for children under the age of six up to 17 years old. 31 2021 will receive the full 3600 tax.

The JCT has made. Last December the CBO estimated that making the 2021 credit. However a child born or added to your family such as through adoption in 2021 can be a qualifying child for the full 2021 Child Tax Credit even if you did not receive monthly Child Tax.

Last December the CBO estimated that making the 2021 credit under ARPA and the TCJA permanent would cost 1597 trillion between 2022 and 2031. For parents of children up to age five the IRS is paying 3600 per child half as six monthly payments and half as a 2021 tax credit. From July to December of 2021 eligible families received up to 300 per child under six years old and 250 for children between the ages of six to 17.

Added January 31 2022 Q A9. Will i get the child tax credit if i have a baby in december. The Child Tax Credit under the American Rescue Plan rose from 2000 to 3000 for every qualified child over the age of six and from 2000 to 3600 for each qualifying child.

Bidens 3000 child tax credit starts going out. Lets say you qualified for the full 3600 child tax credit in 2021. How much is child Tax Credit in December 2021.

The new advance Child Tax Credit is based on your previously filed tax return. How does the second phaseout reduce the Child Tax Credit.

The Child Tax Credit Toolkit The White House

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

Irs Announced Monthly Child Tax Credit Payments To Start July 15 Forbes Advisor

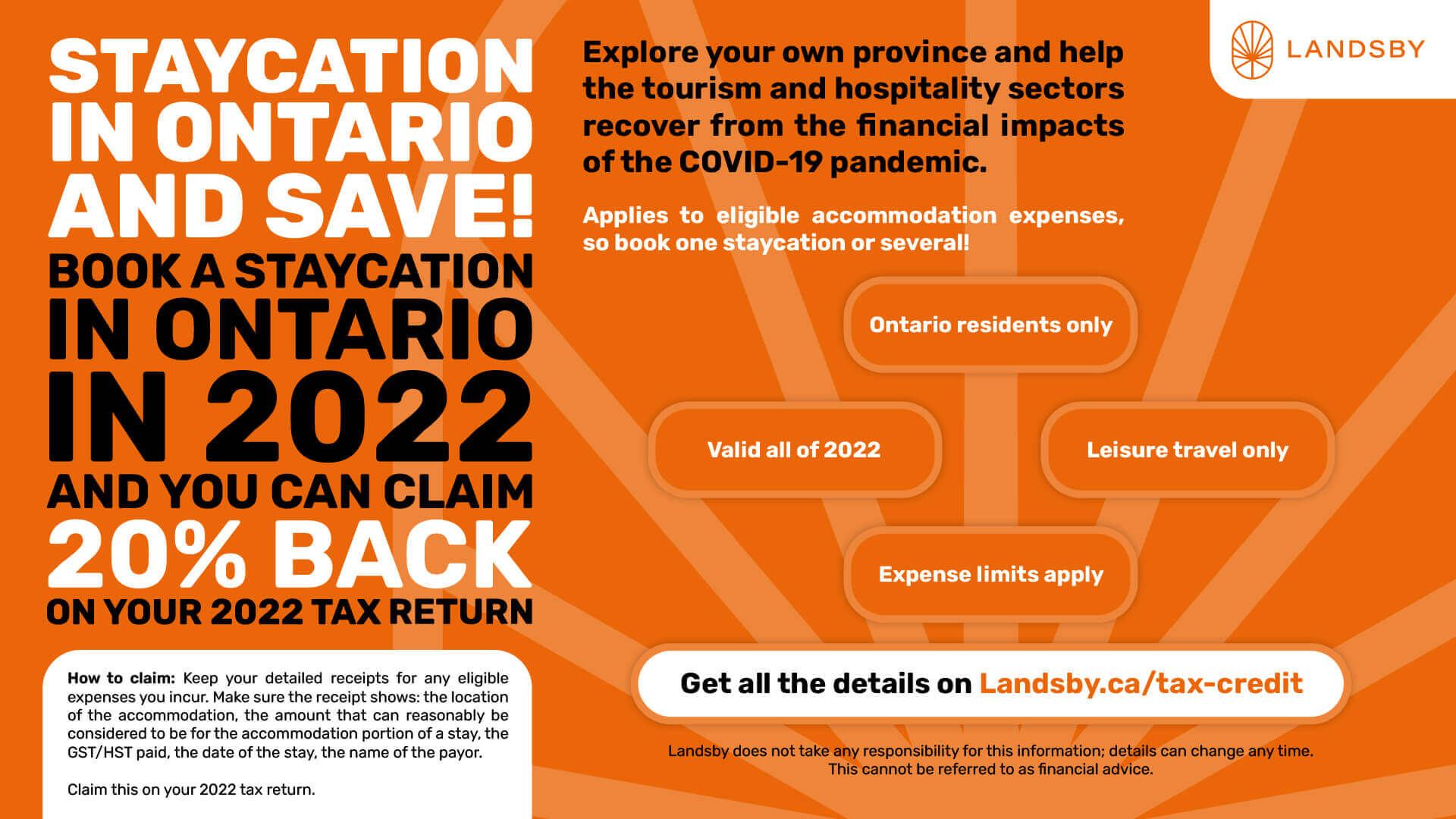

2022 Ontario Staycation Tax Credit Guide Landsby

2021 Child Tax Credit Advanced Payment Option Tas

Parents Guide To The Child Tax Credit Nextadvisor With Time

The Child Tax Credit Toolkit The White House

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

Child Tax Credit Definition Taxedu Tax Foundation

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Did Your Advance Child Tax Credit Payment End Or Change Tas

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Child Tax Credit Could Spur 1 5 Million Parents To Leave The Workforce Study Says Cbs News

Child Tax Credit Ending Will Push 10 Million Kids Back Into Poverty

Will Monthly Child Tax Credit Payments Be Renewed Forbes Advisor

Missing A Child Tax Credit Payment Here S How To Track It Cnet

Who S Eligible For The Child Tax Credit And What It Means This Tax Season Cnet